For People Who Want Predictable Monthly Income Without Selling Assets...

Learn How To Build Monthly Income Without Guesswork or Market Timing

Predictable, low risk, and doesn't take tons of time. Watch this video to learn how!

Master Investment Income With the Proven Income Ladder Strategy!

Videos

6+ Hours Of Videos

Calculators

7 Calculators

Workflows

24 Step-By-Step Guides

The Income Ladder Strategy Course teaches you how to transform your savings into steady, predictable monthly income, no matter what the market does. With this proven approach, you’ll enjoy inflation-proof, hands-off income that grows with your retirement needs, providing financial freedom and peace of mind.

Effortless to Build, Simple to Manage, Reliable for Life!

Here's what the process looks like:

Steady Monthly Income: Turn your savings into predictable cash flow that supports your lifestyle.

Customizable to Your Goals: Adapt the Income Ladder to fit your retirement needs and timeline.

Inflation-Proof Earnings: Protect your purchasing power with income that grows over time.

Diversified Security: Layer bonds, dividend stocks, and real estate for stability and growth.

Hands-Free Management: Enjoy a strategy that practically runs itself with minimal effort.

No Asset Selling: Maintain your principal while generating income consistently.

Financial Confidence: Stop worrying about market crashes and focus on enjoying retirement.

Save on Fees: Eliminate expensive advisor fees by managing your own income strategy.

Secure Your Future: Transform Savings Into Stress-Free Investment Income!

Not a Financial Expert? We’ll Guide You Step by Step.

Inside, you'll learn:

Module 1: Foundations of Income Laddering

Discover the essential building blocks to create a reliable, structured income strategy for retirement.

Learn why transitioning from growth-based investing to income-focused planning is the key to financial security and peace of mind.

Lesson 1.1: Welcome & Getting Started

• Why most traditional retirement strategies leave you vulnerable—and how this course changes everything.

• The three layers of the Income Ladder that create hands-off, predictable income.

• Your step-by-step guide to crafting a retirement plan that works for you.

Lesson 1.2: Why Income Over Growth in Retirement

• Why relying solely on growth-based strategies is a recipe for uncertainty.

• The hidden risks of selling investments for income—and how to avoid them.

• How income-focused investing delivers both financial and emotional peace of mind.

Lesson 1.3: Understanding Bonds: The Basics

• What makes bonds the foundation of a stable retirement income strategy.

• Types of bonds explained: government, corporate, and inflation-protected options.

• How bonds provide predictable cash flow that grows with your needs.

Lesson 1.4: Quick-Start Guide to Bond Investing

• Step-by-step instructions for choosing, buying, and managing bonds.

• How to find the best brokers and platforms for bond investing.

• Tips to automate and streamline your bond investments for consistent income.

Lesson 1.5: Setting Your Retirement Income Goals

• How to calculate exactly how much monthly income you’ll need for a comfortable retirement.

• The key to aligning your goals with your financial timeline and inflation adjustments.

• Tools and templates to create your personalized income roadmap.

Module 2: Public Securities for Income

Explore secure, low-risk public market options that lay the foundation for predictable income streams.

From bonds to dividend stocks, you’ll learn how to diversify and enhance your income portfolio.

Lesson 2.1: CDs and Treasury Bonds – Secure Income Sources

• Why Certificates of Deposit and Treasury Bonds are unbeatable for safety and stability.

• How to ladder CDs for regular, predictable cash flow.

• The tax advantages of Treasury Bonds that maximize your income.

Lesson 2.2: Municipal Bonds – Tax-Advantaged Income

• How municipal bonds help you save thousands in taxes every year.

• The difference between General Obligation and Revenue Bonds—and which is right for you.

• Why municipal bonds are a game-changer for high-income earners approaching retirement.

Lesson 2.3: Corporate and High-Yield Bonds – Enhancing Income with Higher Yields

• The secrets to balancing risk and return with investment-grade corporate bonds.

• How high-yield bonds can boost your income without jeopardizing stability.

• Where to find trustworthy information on bond ratings and yields.

Lesson 2.4: Dividend Stocks and Preferred Stocks – Equity Income Sources

• The hidden power of dividend-paying stocks from companies with decades of reliable payouts.

• Why preferred stocks offer steady income with less volatility than common stocks.

• How to create a diversified equity layer that supports your income ladder.

Lesson 2.5: Real Estate Investment Trusts (REITs) and MLPs – Alternative Income Opportunities

• How REITs provide real estate income without the hassle of property management.

• Why Master Limited Partnerships offer high-yield, tax-advantaged income streams.

• Tips for integrating REITs and MLPs into the upper layers of your income ladder.

Module 3: Building Your Income

Put everything together with a step-by-step blueprint to construct your Income Ladder.

Create a seamless, automated strategy tailored to your retirement goals.

Lesson 3.1: The Income Ladder Blueprint

• The simple, 3-layer structure of the Income Ladder for stability, growth, and inflation protection.

• How layering bonds, stocks, and real estate creates a balanced and secure income stream.

• Why this system eliminates the need to sell investments during downturns.

Lesson 3.2: Setting Up the Bond Ladder

• How to choose bond maturities that align with your short- and long-term income needs.

• Tips for staggering maturities to ensure consistent monthly cash flow.

• The best practices for reinvesting maturing bonds to maintain income stability.

Lesson 3.3: Personalized Income Ladder Planner

• How to document and visualize your entire income ladder with a step-by-step planner.

• The keys to aligning your ladder with inflation, lifestyle, and financial goals.

• Templates and tools to make tracking progress and reinvestments simple.

Lesson 3.4: Automated Bond Reinvestment

• The benefits of automation for stress-free income and portfolio management.

• How to set up auto-reinvestment plans with your broker.

• Strategies for manual reinvestment when automation isn’t available.

Module 4: Inflation-Proofing and Maintaining Your Ladder

Learn how to protect your income from inflation and keep your ladder performing well over time.

Build resilience into your strategy for long-term security.

Lesson 4.1: Inflation-Proofing Basics

• Why inflation is the silent killer of retirement income—and how to combat it.

• How to include inflation-protected assets like TIPS in your ladder.

• Strategies to diversify for long-term purchasing power and stability.

Lesson 4.2: Using TIPS for Inflation Protection

• What makes Treasury Inflation-Protected Securities a reliable inflation hedge.

• The role of TIPS in protecting both your principal and income.

• How to incorporate TIPS into the top layer of your ladder effectively.

Lesson 4.3: Interest Rate Tracker Cheat Sheet

• How to monitor interest rates to optimize your bond purchases.

• The impact of rising and falling rates on your income strategy.

• Tools to help you stay ahead of market trends for reinvestments.

Lesson 4.4: Portfolio Maintenance Calendar

• How to create a low-maintenance schedule for monitoring your ladder.

• Tips for setting quarterly and annual reviews for bond maturities and adjustments.

• Digital tools to automate reminders and reduce management effort.

Module 5: Expanding and Securing Your Retirement Income

Go beyond bonds to diversify your income streams with real estate, syndications, and more.

Learn how to secure your ladder for a lifetime of financial freedom.

Lesson 5.1: Expanding Beyond Bonds

• Why diversification with real estate and dividend stocks enhances your income security.

• How to layer additional assets for maximum stability and growth.

• Strategies to balance bonds with higher-yielding investments.

Lesson 5.2: Transitioning Into Real Estate

• How real estate provides inflation-resistant, monthly cash flow.

• The pros and cons of direct ownership, REITs, and syndications.

• Steps to allocate real estate within your income ladder effectively.

Lesson 5.3: Syndications for Hands-Off Income

• Why syndications are a game-changer for generating passive real estate income.

• How to evaluate syndicators, properties, and fees to reduce risks.

• The benefits of professional management for stress-free investing.

Lesson 5.4: Lifetime Income Security Checklist

• The ultimate checklist to ensure your ladder meets all security and stability goals.

• How to adapt your strategy for life changes or unexpected financial shifts.

• Tips to maintain confidence in your income plan for the long term.

Lesson 5.5: Putting It All Together

• How to consolidate everything you’ve learned into a complete, actionable plan.

• The keys to maintaining and optimizing your ladder for decades to come.

• Celebrate your journey toward financial independence with confidence.

Watch Lesson 1.1

Unlock Tools, Track Progress, Inflation-Proof Income, and Simplify Retirement Planning!

Bonus #1

Retirement Income Goal Planner

This planner helps you set clear monthly income targets and align your financial goals with your retirement timeline. It provides a step-by-step roadmap to calculate exactly how much you’ll need for a secure and stress-free retirement.

Value: $649

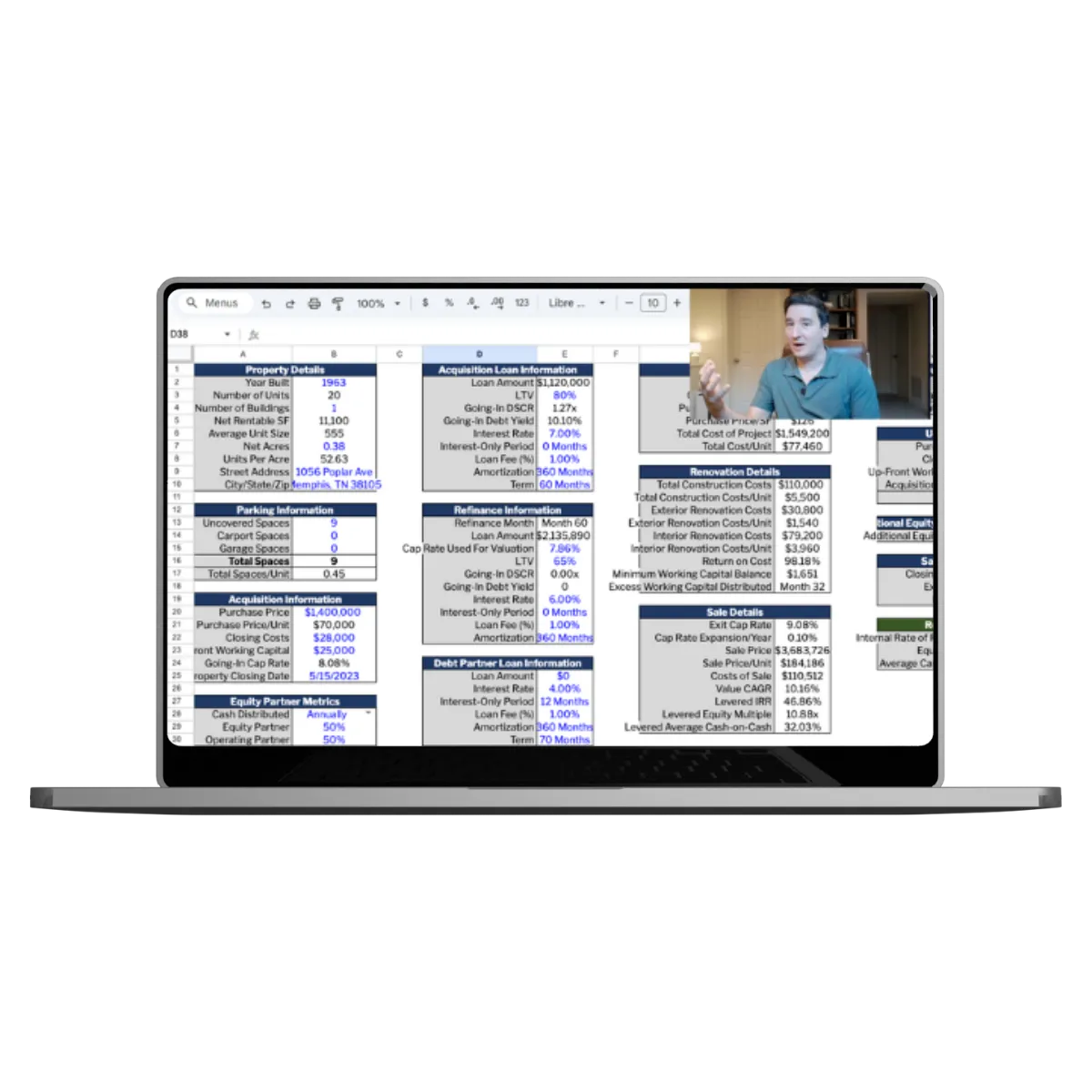

Bonus #2

Retirement Bond Ladder Setup Guide

A detailed guide showing you how to structure your bond ladder for consistent, predictable income. Learn which bonds to select, how to stagger maturities, and automate reinvestments for hands-free management.

Value: $1,159

Bonus #3

Portfolio Optimization Guide

This guide helps you balance risk and return, diversify your income sources, and ensure longevity in your portfolio. It’s designed to maximize your income while keeping your retirement investments stable and secure.

Value: $579

Bonus #4

Hands-Off Income Tracking System

An automated system that simplifies income tracking and keeps you in control without constant monitoring. It helps you streamline your financial oversight so you can focus on enjoying your retirement.

Value: $439

Bonus #5

Retirement Security Planning Guide

This guide offers practical strategies to safeguard your retirement income against risks like inflation and unexpected expenses. It ensures your financial plan stays robust and adaptable no matter what comes your way.

Value: $569

Bonus #6

Income Ladder Progress Tracker

A powerful tool to help you track milestones, reinvestments, and progress toward your income goals. Stay on course with a clear visual plan and actionable next steps.

Value: $345

Bonus #7

Financial Goal Alignment Checklist

This checklist ensures your income ladder aligns with evolving financial needs, lifestyle changes, and inflation. Regularly review and adjust your strategy with confidence.

Value: $235

Why Join Our Program?

You'll love it or we'll give you your money back no questions asked!

Guaranteed!

There is no risk for investing in education that will protect your family!

"My income went up during a market crash!"

From Confused to Confident—Built Steady Income That Grows, Even in Crashes! - Anthony H.

"My income comes in no matter what happens."

Market Anxiety to Reliable Monthly Income—Stress-Free Retirement! - Gary H

" I like things to be simple, and this course really made sense."

Simple Strategy, Reliable Income—No More Retirement Uncertainty!." - Stephen W

"Now, I don’t worry about what the market does—my income stays steady no matter what."

From Retirement Stress to Reliable, Worry-Free Monthly Income! - Frank G

"The course showed me how to set up a plan"

From 401(k) Uncertainty to Steady, Inflation-Proof Retirement Income! - Heather T

The Income Ladder: Predictable, Inflation-Proof Income Without Market Stress!

The Income Ladder uses a structured approach to layer bonds, dividend stocks, and real estate. Each layer is designed to provide stable, predictable monthly income that adjusts with inflation. The foundation starts with secure bonds for guaranteed payouts, like a second Social Security check.

Mid-layers add corporate bonds and dividend stocks for higher returns and steady growth. The top layers include inflation-protected bonds and real estate to keep income growing over time. Once set up, the ladder runs almost on autopilot, requiring minimal management from you. This strategy ensures you never need to sell assets during market downturns or crashes.

Instead, you enjoy stress-free, hands-off income that supports your lifestyle in retirement.

Build Your Ladder Today—Enjoy Steady, Hands-Free Income for Life!

You’re right to feel uneasy about relying solely on the stock market for retirement.

Market crashes and inflation make it impossible to predict how long your savings will last.

You’ve been told to focus on growing your nest egg, but growth doesn’t guarantee income.

The truth is, traditional retirement strategies aren’t designed to replace your paycheck.

Most financial advice skips over how to create stable, predictable monthly income.

Without a clear system, it’s easy to feel stuck, uncertain, and overwhelmed by options.

The real issue? You don’t have a proven strategy that turns savings into hands-off income.

But it’s not too late to fix this and take control of your retirement.

Stable Monthly Income: Enjoy predictable, reliable cash flow without worrying about market crashes.

Diversified Security: Combines bonds, dividend stocks, and real estate for a balanced income plan.

Inflation Protection: Layers that grow with inflation ensuring your purchasing power stays intact.

No Selling Needed: Keep your principal intact while living off the predictable income generated.

Hands-Off Management: Once built, your Income Ladder runs almost entirely on autopilot.

Stress-Free Retirement: Eliminate stressful market monitoring and all the financial anxiety.

Customizable Strategy: Tailored to your financial goals, risk tolerance, and retirement timeline.

Scalable for Growth: Expand your ladder over time to further increase income and stability.

This Strategy Gave Me Confidence And Eliminated Stress!

Hi, I’m Patrick Imperato, Owner of Tala Partners.

A real estate syndicator and income strategist.

Like many, I used to think a big nest egg was the key to a secure retirement, until I watched my parents struggle.

They followed traditional advice, relying on market growth, and ended up selling investments during a crash.

That’s when I discovered the Income Ladder strategy, a way to create steady, predictable income no matter the market.

I implemented it for myself, transitioning my savings into income streams that grow and adjust with inflation.

Now, I enjoy financial freedom, peace of mind, and the ability to spend quality time with my family.

This strategy gave me confidence in retirement and eliminated the stress of managing volatile investments.

And I’ve helped countless others achieve the same freedom, now it’s your turn.

Stop Worrying About Retirement: Create Income That Lasts a Lifetime!

You’ve worked hard to save for retirement, but the thought of running out of money keeps you up at night. Maybe you’re tired of watching your portfolio rise and fall with the unpredictable market. You’ve been told to just grow your savings bigger, but what happens when you need steady income?

The truth is, relying on market growth alone doesn’t create the security you need in retirement. It’s not your fault—the financial industry pushes “growth-first” strategies that don’t prioritize income stability. This leaves you stressed, constantly checking stocks, and unsure how long your money will last.

The real problem? You don’t have a structured income strategy to replace your paycheck. But there’s a way to fix this and finally feel confident about your financial future.

Listen...

Retirement should feel secure, but instead, it feels like a gamble. The market’s ups and downs make it impossible to predict your income.

It’s not your fault, traditional advice focuses on growing savings, not turning them into income. You’ve been sold the idea that more money means more security, but that’s only half the truth. The real issue? Without a structured income plan, you’re forced to sell investments just to get by.

Your suspicions are right: market crashes and inflation can eat away at your savings faster than you think. The good news? You don’t need to rely on risky strategies or hope for market recovery.

There’s a better way to secure your retirement—and it starts with building an Income Ladder.

Linda’s Savings Became $3,500 Monthly, Growing With Inflation!

Steady Income.

Bob and Mary Replaced Stock Sales With Predictable Income!

Peaceful Retirement.

Jim’s Income Grew During Market Crashes With Zero Stress!

Inflation-Proofed.

Tom and Linda Automated $3,200 Monthly Hands-Free Income!

Hands-Off Wealth.

Secure Income,

Stress-Free Retirement Today!

Join today & get:

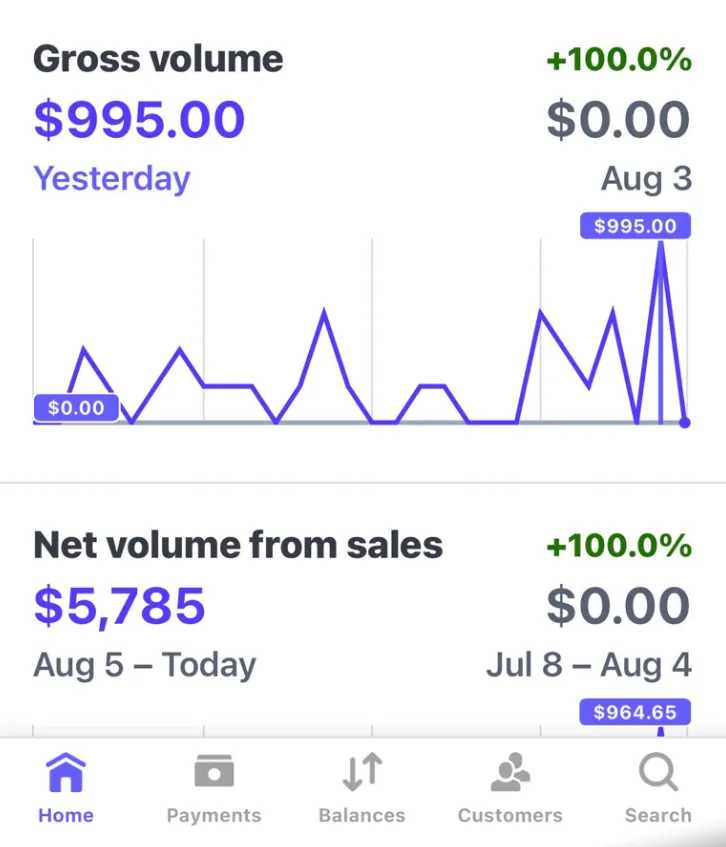

Income Ladder Strategy Course ($1,167)

Retirement Income Goal Planner ($649)

Retirement Bond Ladder Setup Guide ($1,159)

Portfolio Optimization Guide ($579)

Hands-Off Income Tracking System ($439)

Retirement Security Planning Guide ($569)

Income Ladder Progress Tracker ($345)

Financial Goal Alignment Checklist ($235)

Total Value: $5142

TODAY:

$3,997

No risk to you, just education.

Risk-Free Guarantee: Your Satisfaction or Your Money Back!

We’re so confident in the Income Ladder Strategy Course that we offer a 60-day, no-questions-asked guarantee. If you don’t feel it’s the most practical, effective system for creating predictable retirement income, simply let us know, and we’ll refund every penny—no risk, no hassle.

Act Now—Lock In High-Yield Opportunities!

Interest rates and market conditions are creating rare opportunities to secure high-yield income streams—but these won’t last forever. Start now to lock in today’s benefits and build a stable retirement before the window closes.

This Is For You If:

You want predictable, hands-off income in retirement.

You’re ready to transition from growth to stability.

You value a clear, step-by-step system to secure income.

This Isn't For You If:

You prefer high-risk, high-reward investment strategies.

You’re not interested in long-term financial planning.

You want to rely solely on an expensive financial advisor.

Your Biggest Concerns

(And Why They're Actually No Big Deal)

What happens when the market crashes again - will my income disappear?

Nope. Unlike my parents who had to sell in a crash, your income keeps flowing. Bonds mature on schedule, dividends arrive monthly. My income actually went up during the last crash.

I don't have time to manage another investment strategy.

akes 3 hours to set up, then 30 minutes every quarter. That's it. No daily monitoring, no rebalancing. It runs on autopilot while you enjoy predictable monthly income.

How is this different from what my financial advisor tells me?

Advisors push the 4% withdrawal rule - you sell assets and hope they last. Income Ladder = you never sell anything. Monthly checks from bonds and dividends, plus you save thousands in advisor fees.

Frequently Asked Questions

Is this course complicated?

No, the course is designed with step-by-step instructions, making it easy to follow, even for beginners.

What if I don’t have a large nest egg?

You don’t need millions to start—this strategy works with any amount by building income layers over time.

How much time will this take?

Setting up your Income Ladder can be done in a few hours, and it requires minimal maintenance afterward.

Is this strategy safe?

Yes, the foundation includes low-risk investments like government bonds, ensuring stability and security.

What if I know nothing about investing?

The course explains everything in plain language, starting with the basics so anyone can understand.

Will this work during market crashes?

Absolutely! The strategy avoids selling assets, so your income remains steady even during downturns.

What if inflation rises?

The Income Ladder includes inflation-protected layers like TIPS and real estate that grow with rising costs.

Do I need to hire a financial advisor?

No, this system empowers you to take control, saving thousands in fees typically charged by advisors.

Is this course worth the cost?

Yes! For just $167, you’ll gain a proven strategy that could save you thousands and provide lifetime income.

Can I implement this while still working?

Absolutely! This course is ideal for pre-retirees looking to build income streams before retiring.

How long will it take to see results?

You can start generating income as soon as you implement the first steps of the strategy.

What if I’m not satisfied?

You’re protected by a 60-day money-back guarantee, so there’s no risk in trying the course.

© 2025 Time Travel Media LLC, DBA Tala Partners LLC, Income Ladder Strategy Course – All Rights Reserved

Disclaimer: Tala Partners provides educational courses and resources based on successful income-focused retirement strategies powered by expert-backed financial frameworks. However, results may vary depending on your specific financial situation, investment decisions, and market conditions. We don’t guarantee any specific income levels or financial outcomes. Always ensure your retirement plan complies with federal regulations and fiduciary guidelines when implementing strategy-based materials.